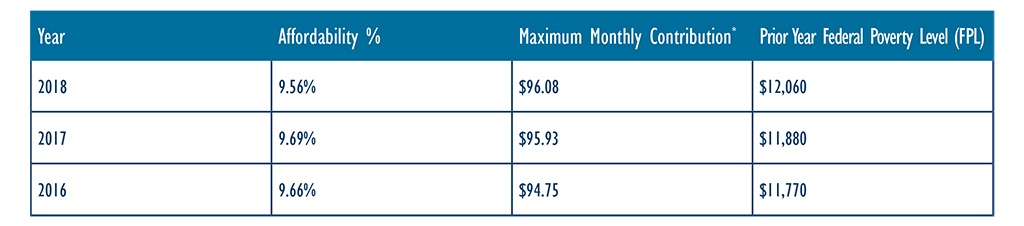

The IRS recently lowered the 2018 affordability threshold to 9.56% of household income for purposes of determining eligibility for a premium tax credit. The 2017 rate was 9.69% of household income. This percentage is also used to determine the affordability of employer-sponsored coverage. Failure to provide a full-time employee with affordable coverage can result in an employer shared responsibility penalty.

Additionally, the IRS lowered the percent of income to 8.05% to determine eligiblity for a 2018 exemption from the individual shared responsibility payment (down from 8.16% for 2017).

For more information, contact your Bukaty benefits consultant at 913.345.0440.