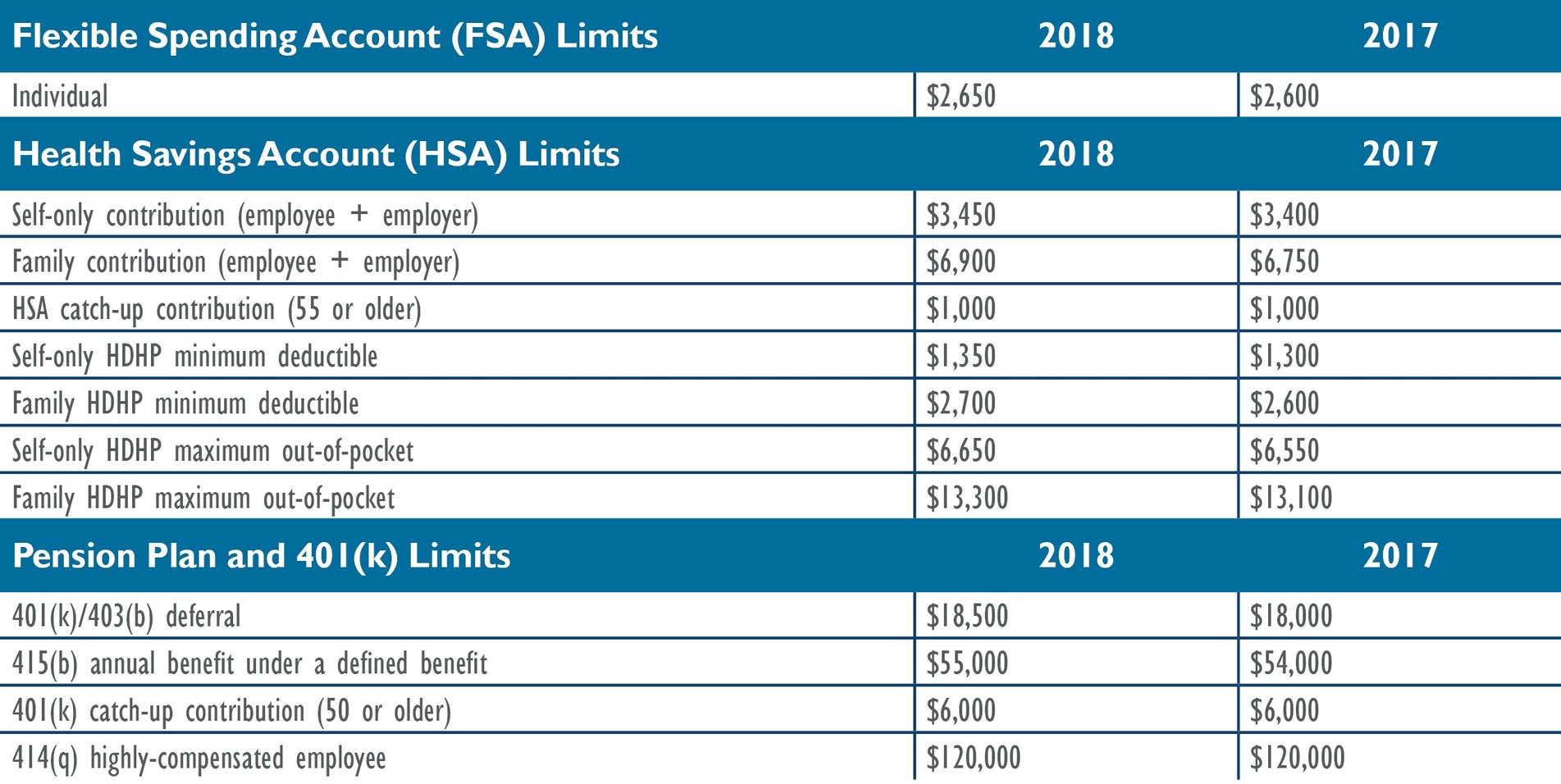

The IRS announced the 2018 contribution limits for multiple tax provisions, including cost-of-living adjustments for Flexible Spending Accounts (FSAs), Health Savings Accounts (HSAs) and pension plan and 401(k) accounts. The limits for each have been increased to deliver greater tax-saving relief for account holders.

Each October, the IRS determines whether retirement and other account dollar limits warrant a cost-of-living increase. Most recently, the cost-of-living index increased by 2.2% for the 12 months ending in September.

If you have questions, contact your Bukaty benefits consultant at 913.345.0440.