IRS-adjusted contribution limits for 2023 Health Savings Accounts (HSA) represent approximately a 5.5% increase over 2022 limits. Changes are effective January 1, 2023. HSAs are tax-exempt accounts that help people save money for eligible medical expenses. To qualify for an HSA, the policyholder...

Bulletins

The IRS recently issued Revenue Procedure 2021-36, lowering the affordability threshold for the 2022 calendar year to 9.61% of household income from the 2021 threshold of 9.83%. This percentage is used to determine an individual’s eligibility for a premium tax credit and the affordability of...

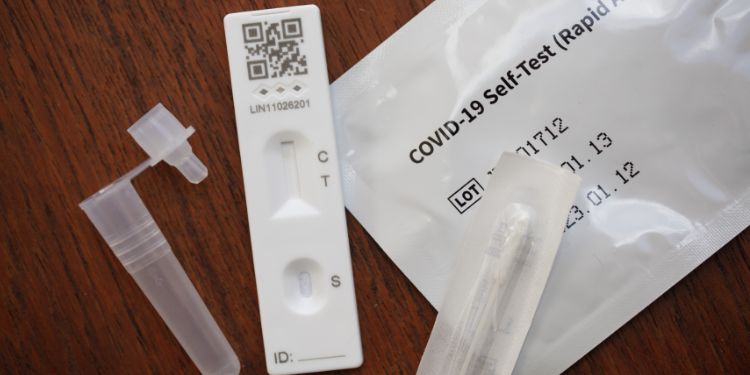

Blue Cross Blue Shield of Kansas City (Blue KC) members can be reimbursed for over-the-counter (OTC), FDA-approved COVID-19 tests by submitting a Blue KC-provided claim form. The OTC COVID-19 test benefit includes up to eight tests per member per month. Members must provide a copy of the receipt...

Humana has identified two options for members to purchase over-the-counter (OTC), FDA-approved COVID-19 diagnostic kits to comply with the Department of Labor’s (DOL’s) directive released last week. The DOL requirement took effect January 15.

Claim form should be submitted providing test purchase date and cost

UnitedHealthcare (UHC) has released information on how UHC members can obtain over-the-counter (OTC), FDA-approved COVID-19 diagnostic kits to comply with the Department of Labor’s (DOL’s) directive released last week. The DOL requirement took effect January 15.UHC has established a preferred...

The Supreme Court ruled today that the Occupational Safety and Health Administration (OSHA) does not have the power to implement its emergency temporary standard (ETS) requiring large employers (100-plus employees) to ensure their employees are vaccinated or undergo weekly testing and wear masks...

Reimbursement not required for employment-purposes testing

Qualified testing remains at $0 cost-share; member responsible for cost of non-qualified testing

OSHA announces enforcement delayed until January 10 and February 9