For 2017, employee 401(k) contributions will once again cap at $18,000 while still allowing an additional $6,000 “catch-up” contribution for those age 50 or older. Total maximum contributions from both sources (employee and employer combined) will increase by $1,000.

The IRS announced other defined contribution and defined benefit plan limit adjustments in their recently issued Notice 2016-62.

Annual limits and maximums for 401(k) and similar defined contribution retirement plans have remained steady in response to a minimal increase in the cost-of-living index (a mere 1.09% rise between 2015 and 2016) which failed to trigger rate adjustments. The last employee contribution limit increase occurred in 2015 with a $500 jump from 2014.

On the other hand, employer-provided contributions to 401(k) type plans have increased almost 2%. Employers will be able to contribute an additional $1,000 even if plan participants contribute to the individual limit. This raises the annual defined contribution limit from all sources from $53,000 to $54,000.

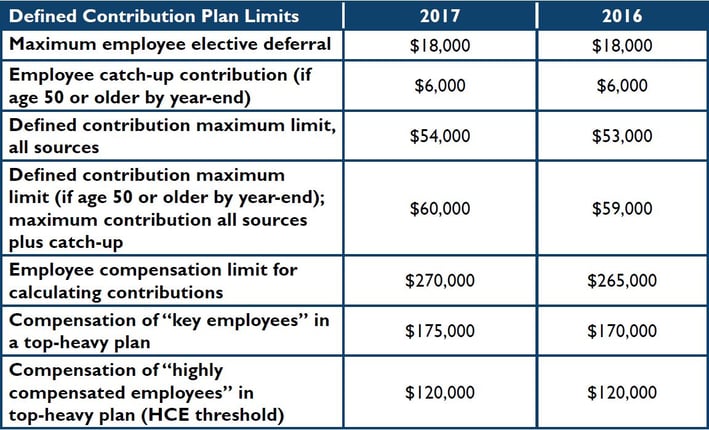

The table below outlines additional changes found in the Notice.

*“Key employees” and “highly compensated employees” are terms used for testing purposes in the annual nondiscrimination testing of a retirement plan. The $6,000 catch-up contribution limit for participants age 50 or older applies from the start of the year to those turning 50 at any time during the year.*