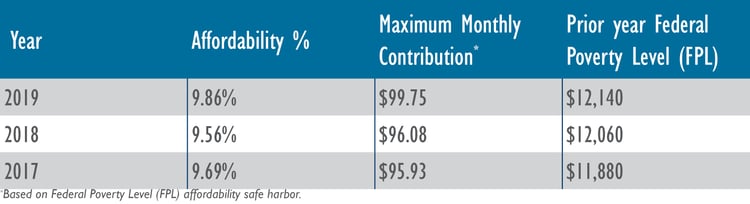

The IRS recently raised the affordability threshold for the 2019 calendar year to 9.86% of household income from the 2018 threshold of 9.56%.This percentage also is used to determine the affordability of employer-sponsored coverage for applicable large employers (employers with 50 or more full-time equivalent employees). Failure to provide a full-time employee with affordable coverage can result in an employer shared responsibility penalty.

Methods for determining affordable health coverage under the Affordable Care Act

Employers have three options available when setting employee premium contributions that meet affordability requirements. Assume the employer has a calendar plan year

for 2019 in each example.

W-2 safe harbor: Jeff is employed at ABC Inc. for the entire year and is offered coverage for all 12 months. According to Box 1 of his W-2, his wages total $35,000. ABC Inc. will be considered to offer affordable coverage if Jeff is not charged more than $287.58 per month for coverage. The formula is ($35,000 x .0986)/12 = $287.58.

Rate-of-pay safe harbor: Emily works for Acme Corp. and makes $15 per hour as of the start of the plan year. Acme Corp. will be considered to offer affordable coverage if Emily is not charged more than $192.27 per month for coverage. The formula is ($15 x 130) x .0986 = $192.27.

Federal Poverty Level (FPL) Safe Harbor: The most recently published mainland FPL for a household of one is $12,140. ABC Inc. will be considered to offer affordable coverage to employees who are not charged more than $99.75 per month for coverage. The formula is ($12,140 x .0986)/12 = $99.75.

To confirm your organization is using the appropriate safe harbor, contact your Bukaty benefit consultant at 913.345.0440.

For questions, contact your Bukaty benefits consultant at 913.345.0440.