For employers looking to better manage their health care spend and still provide comprehensive coverage for their employees, voluntary benefits have risen in popularity with businesses of all sizes and industries.

These voluntary plans, such as critical illness, long-term disability, or accident, allow employees to enrich their traditional benefits package while protecting themselves from financial disaster should something catastrophic happen.

A recent survey conducted by the Employee Benefit Research Institute (EBRI) reported three-quarters of employees said the benefits package offered is a critical factor in their decision to accept or reject a job. And with 92% of U.S. employers agreeing that voluntary benefits will play a vital role in the employee value proposition over the next several years*, the growing popularity of these plans comes as no surprise.

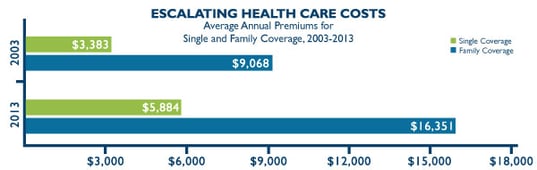

As health care costs also continue to rise, more and more businesses have adopted self-funded plans.

Up from 49% in 2012, a notable 55% of employers with 500-1000 employees self-funded in 2013 along with 31% of employers with under 500 employees.

Working together as cost-saving duo, self-funded plans and voluntary benefits have aided employers struggling to strike a balance between quality benefits and lowering costs.

A business’ self-funded dollar stretches further for several reasons; with a big factor being, they are no longer subject to state health insurance premium taxes or carrier profit margins. Employers pay for medical claims the plan actually incurs instead of the margin underwritten into their premium with a fully insured plan.

In addition to those advantages, self-funded plans may not be subject to Affordable Care Act regulations to the extent that fully insured plans are.

In the end, whether or not an employer is self-funded, voluntary benefits help employees play an active role in their health care plan and provide an opportunity to build financial security. The formidable combination of the two, however, is a powerful solution employers looking to manage costs cannot ignore.

For questions or information on self-funded plans or voluntary benefits, contact your Bukaty benefits consultant at 913.345.0440.