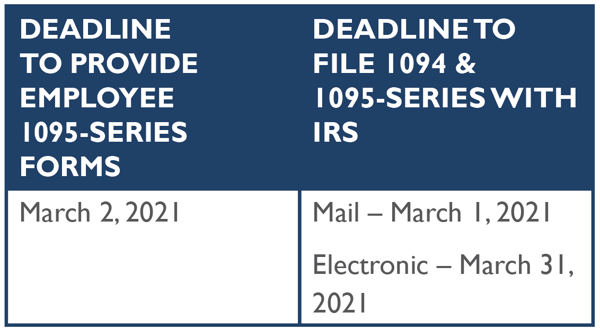

In Notice 2020-76, the IRS extended the January 31, 2021, deadline to submit 2020 employee 1095-B and 1095-C ACA forms to March 2, 2021. The Notice does not extend the deadlines for employers to file ACA forms with the IRS.

The Notice also extends the good-faith reporting relief for an additional year for employers who unknowingly submit forms that are inaccurate or incomplete. The Notice states that the 2020 reporting year is the last year this type of relief is available. Penalties for noncompliance can be costly. A $280 penalty per return can be applied for

failure to furnish ACA forms or issuing incorrect forms to employees. Additionally, another $280 per-return penalty can be assessed for failing to timely file with the IRS

(or filing inaccurate forms).