Since our August update on a proposed IRS rule, a final rule was released that eliminates the long- criticized “family glitch” in the Affordable Care Act (ACA). Prior to the new rule, family eligibility for premium tax credits (PTCs) through Healthcare.gov was based on the cost of coverage for an employee who had access to employer-provided health insurance. While the employee’s self-only coverage may be affordable based on IRS affordability thresholds (9.12% of household income in 2023), the higher cost of family coverage was not considered for purposes of PTC eligibility.

Starting with the November 1 open enrollment through Healthcare.gov, families who pay more than 9.12% of their household income for employer-sponsored family health insurance could be eligible for a PTC. Employees provided an affordable offer of employer-sponsored, self-only coverage would continue to be ineligible for a PTC.

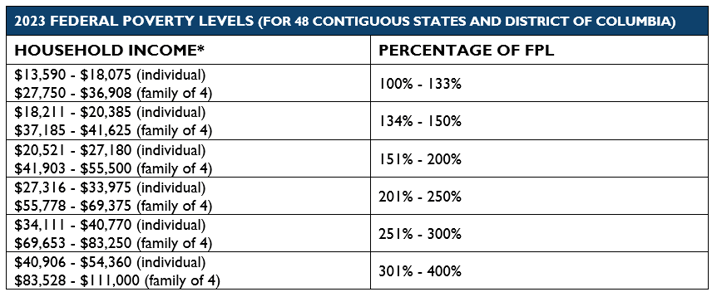

PTC eligibility is linked to household income. Generally, subsidies are available for those whose household income is at 400% or less of the federal poverty level (FPL), which is adjusted annually by the Department of Health and Human Services (HHS).

*Household income is defined as modified adjusted gross income. The American Rescue Plan lowers out-of-pocket costs for coverage obtained through Healthcare.gov and expands subsidy eligibility for those above 400% of the FPL who don’t have access to affordable coverage through an employer or non-ACA plan.

Employees who want to evaluate whether dependents and spouses are eligible for a PTC can request a quote from Bukaty’s Life Transition ACA enrollment service. (Link works best using Chrome browser.) For additional information, contact your Bukaty benefits consultant at 913.345.0440.