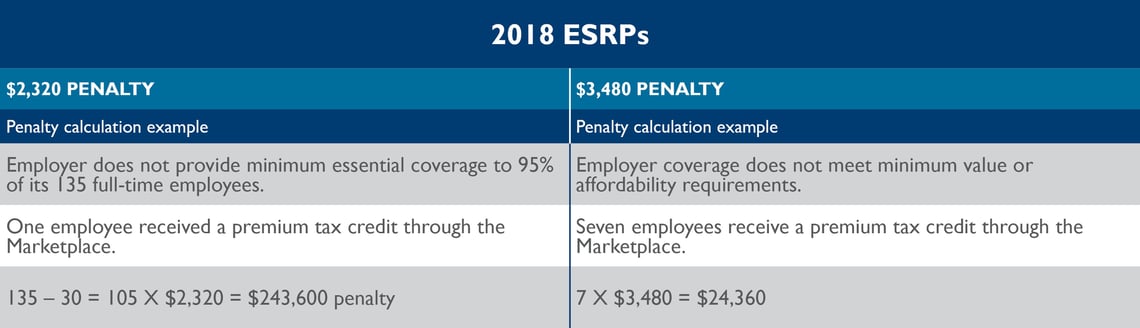

The employer shared responsibility penalties (ESRPs) for 2018 are $2,320 and $3,480 per employee. The $2,320 penalty is applied should an applicable large employer (with 50 or more full-time-equivalent employees) not provide minimum essential coverage to at least 95% of benefit-eligible, full-time employees. If at least one full-time employee receives a premium tax credit for receiving coverage through the Marketplace, the $2,320 penalty applies to all full-time employees (minus 30).

In the event the employer provides minimum essential coverage, yet it doesn’t meet minimum value or affordability requirements, the $3,480 penalty will be apply to each employee who received a premium tax credit.

The IRS also increased the penalty for noncompliance with the ACA reporting requirement. Failure to file 1094/1095 information reporting forms for the 2018 tax year will cost employers $270 per individual employee return, up from $260 per return in 2017. Because an employer (with 50 or more full-time-equivalent employees) is required to provide the IRS with the same form an employee receives, the penalty per benefit-eligible employee could be $540. Penalties for willful failure to comply are double.